Chase Bank, JPMorgan Chase & Co.'s consumer banking arm, is one of the nation's largest full-service banks. It offers a broad range of financial products and services to individuals and businesses. In addition to checking, savings and CD accounts, Chase is well known for its extensive credit card offerings, including popular travel rewards and cash back credit cards. With options for adults, students and kids, Chase has accounts to fit most needs. For people who want to earn interest on their money, there is the Chase Premier Plus checking account. The current interest rate paid on the balance of the account is 0.01% although that does change.

The minimum amount required to open a Premier Plus checking account is $25. Those who have the Premier Plus checking account also can use any of Chase's in-network ATMs for free and get 24-hour online banking access and online bill pay as well as Chase customer service. The monthly service fee for a Total Checking account is $12, but there are ways that you can get that service fee waived. Total Checking requires a minimum deposit of $25 to open an account. That $12 fee is cut in half for students currently enrolled in high school or college. Total Checking account holders pay no Chase ATM fees at any in-network ATM and deposits can be made at in-network ATMs as well.

Total Checking account holders also have full and free access to Chase's online banking and online bill paying features. One of the better offerings from the banking giant is Chase College Checking. The account is designed for college students ages 17 to 24. There is no monthly service fee for college students for up to five years while you attend school, provided you show proof of your student status. The account comes with a free debit card and account access online and through Chase's mobile app.

Chase labels three of its checking accounts as "everyday" checking accounts. All three accounts offer access to nearly 16,000 ATMs and more than 4,700 branches nationwide. Each account offers online banking, online bill pay and mobile banking, as well as automatic transfers to Chase savings accounts. Chase offers several tiers of checking and savings accounts. Each account grants its owner access to all of the bank's physical locations and ATMs as well as Chase's online banking and mobile app.

However, saving account fees are waived if you have a savings account that is tied to a Premier Plus or Premier Platinum checking account. You can also get the saving account fees waived if you have a minimum daily balance of $300 or more or if you have an automatic repeating transfer of $25 or more into the savings account each month. If you have a Chase savings account and you are under 18 years old, there is no monthly service fee. Whether you're just starting college or have been hitting the books for a few years, if you don't have a checking account, it's a good idea to set one up. Checking accounts make it easy to handle your personal finances, including check deposits, bill payments and making online purchases. It's also safer to carry around a debit card instead of cash — if the former gets stolen, you can immediately shut down the card to prevent further losses.

Once you have a new account, transfer the money from your Chase account to it. Don't transfer all your money; leave a small cushion for any banking fees. Not all banks offer debit cards attached to savings accounts, but Chase does. If your account has a debit card, stop using it and let the Chase account sit for a week so all the debit card transactions are completed.

If a charge comes in after you close the account, it will automatically reopen and you will be charged an overdraft fee for that transaction. The Chase Total Checking® account offers a $225 bonus for new customers and a top-rated mobile app that makes banking easy. With both physical and online banking options, you can tailor your experience to your needs. Chase Total Checking ranks on our list of best checking account bonuses of 2021 because, in addition to the signing bonus, there is no minimum balance requirement to open a new account. Having a checking account also makes it easier to track your spending since you can view your account balance and all of your transactions and debit card purchases online or on your monthly statement. If you decide you'd still like some cash in your pocket, it's easy to withdraw money from your account at any time with an ATM machine or by getting cash back during purchases.

If you don't have one already, there are many great reasons to open a business credit card. For example, pairing your Chase business checking account with a Chase business credit card for all of your business expenses will help you earn valuable points and rewards. There will be no fees to open the Chase current account and start earning cashback rewards. Customers will receive the cashback rewards without needing to switch their banking provider, commit to a minimum account balance or set up direct debits. The 1% cashback is payable when customers use their Chase debit card in person or online, and will be offered at retailers at home and abroad. Chase Bank offers a robust selection of checking accounts to meet varying banking needs.

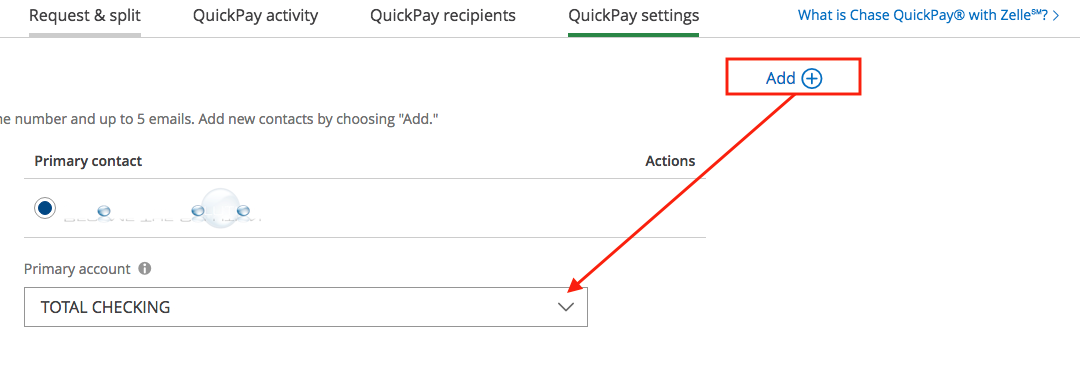

Like its savings accounts, most of Chase's checking accounts feature a monthly service fee. Chase generally offers ways to waive these fees, though. In online banking, you will first need to add an account. From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers.

You can set up same day/future dated/recurring transfers in either online banking or the mobile app. More convenient than cash and checks — money is deducted right from your business checking account. Make deposits and withdrawals at the ATM with yourbusiness debit card. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. For Chase banking customers, QuickBooks offers a number of powerful tools for managing a business.

One of these tools is the software's ability to track income and expenditures and keep accounts in sync by integrating with the bank's software systems over an Internet connection. As a customer of Chase, you download account transactions to an external file and import them into QuickBooks with no fee. You can also create a direct connection to Chase from within QuickBooks and receive transactions automatically for a monthly fee.

Once the transactions are available, you can use the information to reconcile accounts and simplify your financial bookkeeping. If you're enrolling in mobile and online banking to access your business accounts, you'll need an ATM or debit card. You can apply for these at a branch and use your PIN to log in to mobile or online banking.

Next, create a unique username and password to log in securely in the future. New customers can sign up at chase.co.uk , after which they will be invited to download the Chase app. Customers can open a current account in minutes via the simple and intuitive app. The account offers a range of features to help people budget, manage money, spend and save. A U.K.-led customer support team will be a key part of the Chase banking experience.

With just a few taps in the Chase app, customers will be connected to a specialist – 24 hours a day, 7 days a week. New customers can sign up at chase.co.uk, after which they will be invited to download the Chase app. For personal accounts, you will need to provide your Social Security number, email address and phone number to enroll in Online Banking. You will also be asked to verify your enrollment using either your ATM/CheckCard Number and PIN, or a Customer Number .

You'll have until the end of the business day/cutoff time to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions. There's a three-per-day maximum for these fees (totaling $102), and they don't apply to withdrawals made at an ATM. Each checking account gives users access to mobile banking, including online bill pay, and comes with a debit card that has a security-enhancing chip. A large international bank like Chase gives customers access to a huge network of ATMs and branches almost anywhere, however, it also typicallycharges fees for its accounts.

These charges include Chase overdraft fees, monthly services fees, checking account fees, wire transfer fees and ATM fees for using a non-Chasemachine. Only you can decide if you'd like to become a Chase customer. In banking, service fees or account fees are fees charged to your bank account to cover services offered by the bank. For example, you might be charged a service fee for using an ATM, transferring money or setting up an account. Some banks also charge monthly service fees, sometimes called maintenance fees, that might be waived if certain conditions are met.

Since college students often have very different financial habits and concerns than adults who have entered the workforce, many banks offer checking accounts designed for college students. In this article, we cover six things you need to know if you're considering opening a student checking account through Chase bank. In addition, make sure you don't have any recurring payments set up that draft from your checking account. This could include credit cards, utilities, auto loans, mortgages, subscriptions or other accounts you've set up to draft from your account each month. To avoid missing any annual recurring payments, review 12 months' worth of checking account statements. To determine which checking accounts provide the best place to deposit your money and earn a bonus, Select analyzed dozens ofU.S.

Checking accountsoffered by online and brick-and-mortar banks, including major credit unions. We narrowed down our rankings by only considering checking accounts that have bonuses available to new applicants. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other U.S. financial institutions.

Wells Fargo gives you flexibility, convenience, and control to transfer funds where and when you need it. Simply sign on to Wells Fargo Online to access transfers, and click Add Non-Wells Fargo Accounts to get started. Chase maintains a strong digital footprint with its popular mobile app and online banking platform. Yet, it still offers an extensive local presence for individuals who prefer in-person banking services. If you can avoid the monthly fees, Chase is a solid option for your personal banking needs. So you've made the decision to close your Chase account.

By this point, you've probably realized that their rosy promises of free checking accounts and high-yield savings accounts were just leading you into a labyrinth of hidden fees and charges. And to add insult to injury, an interest rate that hovers between 0 and 0.01%; making you effectively zero income on your precious deposits. Eligible accounts for linking to KeyBank online and mobile banking include checking, savings, credit cards, loans and investments.

• Some features are available for eligible customers and accounts only. Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions or checks you have written. A qualifying Chase transfer account is required to transfer funds via text.

Open a new Chase College Checking account online or in a branch. Complete at least 10 qualifying transactions within 60 days of account opening. Qualifying transactions are debit card purchases, online bill payments, checks paid, Chase QuickDeposit℠, Chase QuickPay with Zelle®, or direct deposits. Chase College Checking account is open to college students who are years old. Chase offers checking accounts, each with access to mobile or in-person check deposit as a debit card. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit.

Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Chase offers online and mobile banking, including the ability to deposit checks via the Chase mobile app, which means you can bank from just about anywhere. As you can see, Chase provides many good methods to discontinue your account with them.

For the sake of convenience, you can call or close your account online. If you feel more comfortable doing it in person, visit a Chase branch. Withdraw most of your funds, make sure there's no pending balance, and wait for all debit card transactions to clear. Earn $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

There's no annual fee.If you're not sold on any of the Chase business credit cards, there are many other great business credit cards on the market that are worthy of your consideration. If the concept of earning and redeeming points and miles seems a bit too complex — don't worry! We've put together a dedicated ultimate guide to points and miles for business owners to help you hit the ground running. There is a monthly service fee of $95 that is waived when you maintain an average daily balance of $100,000 in qualifying business deposit and business investment accounts. Even with this premium account, the required minimum deposit is still only $25.

We all know how great Chase business credit cards are, but what about their banking services? If you're in search of a great checking account for your business, see how Chase stacks up. Your earnings depend on any associated fees and the balance you have in your checking account. To open an account, some banks and institutions may require a deposit of new money, meaning you can't transfer money you already had in an account at that bank.

When you open the app, you are first brought to the main menu that shows all your active Chase accounts. Why can I no longer download my credit card transactions into my software? To download credit card transactions, sign on to KeyBank online banking and select Download Transactions. You will be able to download credit card transactions into your Quicken software.

QuickBooks download for credit card information is not available at this time. Can I edit or delete a pending payment or transfer in online banking? In online banking, upcoming activity is displayed in the account details page of each account. Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon. Select the payment you wish to cancel in the Bill Payments menu. Chase offers a wide variety of business checking accounts for small, mid-sized and large businesses.

Compare our business checking solutions and find the right checking account for you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches.

You won't be charged any fees for making purchases or cash withdrawals outside the UK. While this isn't unique for a challenger bank – competitors, such as Monzo and Starling, offer this too – it's a nice feature to have if you're planning to travel overseas. For more on the best debit cards to use on holiday, check out our Travel cards guide. In the checking account section you can see a breakdown of your financial transactions, including money coming in and coming out. I transferred $850 from my traditional Chase account via the app in a matter of seconds.